(Picture: The Edge Markets)

(Picture: The Edge Markets)

AmBank has launched two new enterprise bank cards, the AmBank Visa Platinum Enterprise Card and the AmBank Visa Infinite Enterprise Card, to serve the assorted wants of Malaysian enterprise homeowners. Each playing cards are designed to supply improved comfort, particularly by way of funds and the flexibility to streamline and consolidate their company bills beneath one account.

Particularly, the AmBank Visa Platinum Enterprise Card is focused at SME prospects, providing 1x AmBonus Level for each RM1 spent on eligible native bills, and 2x AmBonus Factors for abroad spend. Observe that AmBank defines abroad spend right here as solely card transactions made exterior of Malaysia; all on-line transactions carried out with abroad distributors should not eligible to earn 2x AmBonus Level.

Different perks that AmBank Visa Platinum Enterprise cardholders may take pleasure in embrace 2x entry to the Plaza Premium Lounge and rebates by way of the Membership Marriott Malaysia annual membership. These are along with complimentary private accident and journey protection valued at RM30,000 and RM1 million, respectively, in addition to an interest-free reimbursement interval of 28 days (after billing interval) and simple fee plans for higher money stream optimisation.

In the meantime, the AmBank Visa Infinite Enterprise Card is designed for bigger companies, corresponding to wholesale banking and enterprise banking prospects. These cardholders can earn as much as 1% cashback on abroad transactions and chosen enterprise bills – with no cap on how a lot you possibly can earn and no minimal spend requirement. The cashback rewards that may be earned are tiered as under:

Expense class

Cashback Abroad transactions (excluding on-line transactions) 1% Petrol, airways, lodge, and F&B 0.5% Different spend (excluding money advance, JomPay, and authorities companies) 0.1%

Furthermore, cardholders will take pleasure in 5x complimentary entry to the Plaza Premium Lounge, rebates by way of the Membership Marriott Malaysia annual membership, and journey insurance coverage protection of RM2 million. They’ll additionally faucet into the same interest-free reimbursement interval of 28 days (after billing interval) and simple fee plans.

Retail banking supervisor director of AmBank, Aaron Bathroom stated that the 2 new playing cards are supposed to fill a crucial hole within the wants of enterprise homeowners, particularly as they’re nonetheless recovering from the setbacks attributable to Covid-19. The financial institution additionally hopes to help SMEs as a largely underbanked and underserved section, citing information from Visa’s SME Digital Banking Examine.

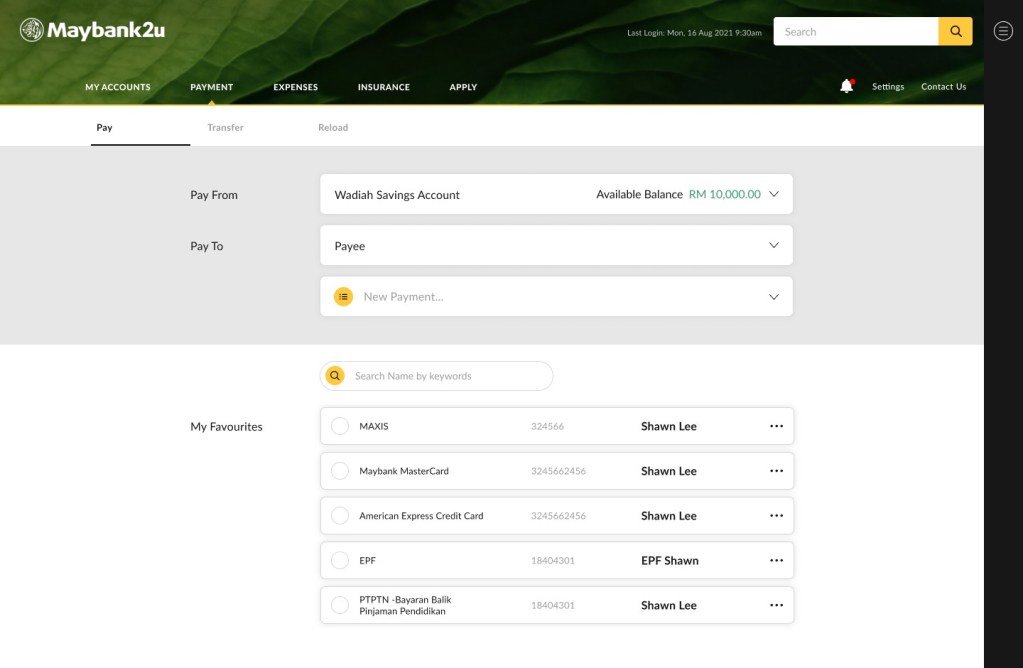

Nation supervisor of Visa Malaysia, Ng Kong Boon, additional stated that offering SMEs with fee playing cards will encourage enterprise homeowners to embark on their digitalisation journey. “Digital funds may also assist SMEs to have higher visibility of their bills, which is able to result in an improved money stream for his or her companies,” he stated.

Each the AmBank Visa Platinum Enterprise Card and the AmBank Visa Infinite Enterprise Card don’t include annual charges; eligible cardholders can utilise it without cost for all times, with no added circumstances.