(Picture: Bernama)

(Picture: Bernama)

A number of banks in Malaysia are at the moment working a survey, which goals to reassess the monetary state of affairs of consumers who had utilized for reimbursement help as a result of Covid-19 pandemic again in 2020 and 2021. It additionally sought to gauge affected prospects’ readiness to revise their month-to-month reimbursement quantities and shorten their tenure in order that they will save on borrowing or financing prices – if their present monetary circumstances permit it.

In case you’ve been banking with Public Financial institution, UOB Financial institution, or Financial institution Rakyat – and have tapped into their Covid-19 reimbursement help – then you could have been contacted by them to participate within the survey. Some key issues that it is best to be aware in regards to the surveys from every financial institution embody:

Public Financial institution

Public Financial institution’s survey is sort of detailed, with two units ready for various teams of consumers:

Survey type

Buyer group

Deadline Retail mortgage survey type Just for focused reimbursement help (TRA) prospects Survey should be accomplished inside 7 days from receiving invite from the financial institution (within the final week of August 2022) Rent buy survey type For rent buy prospects Survey should be accomplished by 31 March 2023

Prospects can select to finish the survey on-line, or obtain the survey type to manually fill it in. In case you decide to obtain and fill within the type manually, your accomplished type should then be emailed to both (retail mortgage survey type) or (rent buy survey type).

PBB additionally famous that prospects who point out a need to revise their month-to-month instalment upwards could also be contacted at a later date. In reality, prospects who want to take action can method the financial institution anytime through the mortgage/financing tenure if their monetary circumstances have improved.

In case you’d like a transparent clarification as to how an elevated month-to-month reimbursement with shortened tenure could profit you, Public Financial institution’s survey web page has ready clear illustrations as properly.

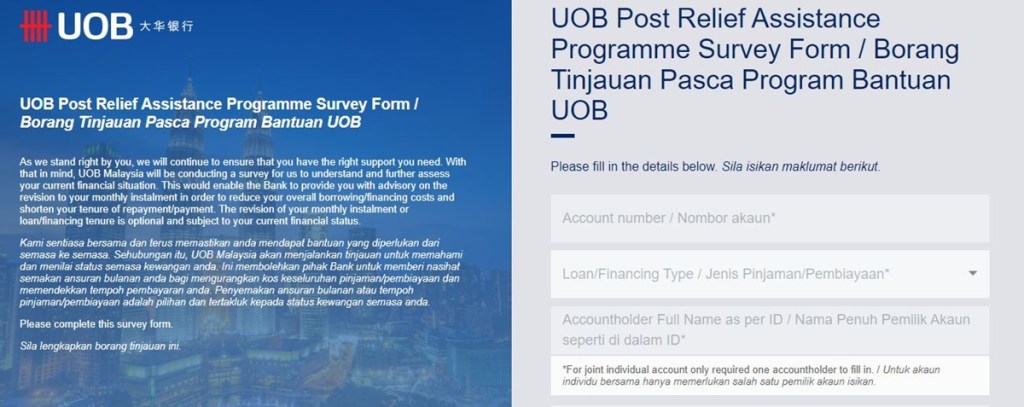

UOB Financial institution

UOB’s post-relief help survey is equally – if no more – concise. Prospects are solely required to fill of their banking and private particulars, and inform the financial institution whether or not they would contemplate shortening their mortgage or financing tenure to be able to cut back their whole curiosity or financing prices.

UOB mentioned that the survey will allow the financial institution to advise prospects on whether or not they can or ought to decide to extend their month-to-month repayments, and by how a lot (if they’re able to). It additionally famous that the revision of consumers’ month-to-month instalment or mortgage/financing tenure is non-compulsory, and is topic to their present monetary standing.

Financial institution Rakyat

Equally, Financial institution Rakyat can be internet hosting its personal post-relief help survey. In contrast to Public Financial institution and UOB – who each constructed a web based platform for it – Financial institution Rakyat mentioned that it’s going to establish and phone affected prospects as a substitute.

In an FAQ, Financial institution Rakyat defined that it’s going to attain out to prospects who requested for reimbursement help between 1 October 2020 to 31 December 2021, and who meet the next standards:

Recognized prospects will first learn of the financial institution’s resolution to pick them for the survey through SMS or e-mail, after which subsequently be contacted for the precise survey at a later date.

Financial institution Rakyat additionally reiterated that this explicit survey solely goals to gather data; those that are concerned about revising their reimbursement quantities shall be contacted a second time after the survey to debate issues intimately.

***