PayTo is a brand new possibility for direct debit funds crafted by Australia’s banks in live performance with New Funds Platform Australia (NPPA).

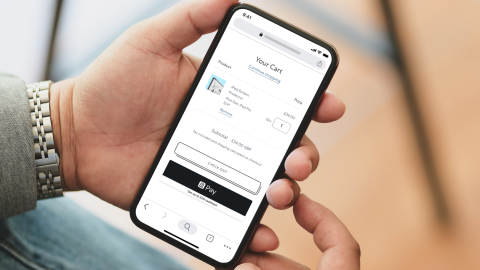

Customers of the system have the flexibility to view, authorise, pause or cancel cost agreements through their web banking copnnection or cell app.

CBA government common supervisor funds, Ethan Teas, feedback: “PayTo has the potential to revolutionise funds in Australia. We’re delighted to be on the forefront of this as the primary main Australian financial institution to supply the PayTo capabilities for our payer prospects, and to trial the capabilities for our enterprise prospects.”

CBA partnered with A2A funds fintech Paypa Airplane – through which it holds a 19% stake – to trial the system with enterprise prospects Telstra and The Shepherd Centre.

Telstra used PayTo to create a cost settlement to allow a buyer to make a invoice cost, and The Shepherd Centre – a incapacity service supplier for youngsters with listening to loss – used PayTo to create a cost settlement to allow a donor to make a donation.

Says Teas: “The trial transactions we now have undertaken with two of our enterprise prospects are proof of the advantages that might be on supply to the broader enterprise group, and we look ahead to working with our companions to make PayTo a drive for optimistic change within the months and years forward.”

When PayTo for companies is absolutely launched, corporations will have the ability to set up it as a substitute for direct debit preparations in addition to third celebration initiated funds like wage disbursements. CBA enterprise prospects may have the ability to settle for PayTo funds in e-commerce environments as a substitute for credit score and debit card funds.,