Being a personal finance writer, I often get approached with questions that imply that I am sitting on a secret hot tip that will lead the inquisitor to personal finance success.

When people ask these questions, what they are really asking for is the shortcut. They want the Konami cheat code to personal finance.

Aspiring wealth seekers are not alone. There are entire industries that seek to profit from individuals in search of such shortcuts. And those shortcuts are usually sold as quick, easy, and without risk. We’ve all seen them before…

“The pounds will quickly melt away with this new groundbreaking fat burning pill!”

“Sign up for our monthly newsletter to get our hot stock pick of the century!”

“I can turn anyone into a successful real estate investor, including you!”

“Grow your dong by 3 inches, with no surgery!”

“We’re going to have insurance for everybody. We’re going to have a healthcare that is far less expensive and far better!”

“This magical cream will make decades of wrinkles disappear overnight!”

“Make $100,000 per year, working from home!”

“Get in to the home of your dreams – with no money down!”

“Who’s going to pay for the wall? Mexico!”

“Follow these dating tips and the ladies will find you irresistible!”

“Eat this powder and get shredded!”

“With the advice in this career workshop, you’ll land the job of your dreams in no time!”

“CRYPTO. CRYPTO. CRYPTO!!!”

If it’s something we care about – money, debt, physical appearance, health, safety, stuff/toys, sex, education, career, etc. – there are plenty of hucksters, grifters, and snake oil salesmen out there eagerly selling us the shortcuts. And personal finance is full of them.

Sadly, almost all of them are traps. As with all things, if there was a fail-safe shortcut, everyone would be doing it, after all.

Here’s the thing: there are shortcuts in personal finance. But, they aren’t quick, easy, or effortless. And most people aren’t willing to do what it takes in order to realize them.

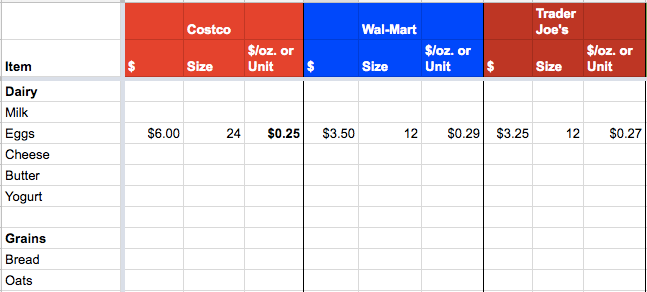

For example, turbo-charging your personal savings rate through a series of hundreds or thousands of optimizations on income and spending is a shortcut (albeit a many year or even decades long shortcut) to financial independence and personal finance success. However, it takes study, effort, time, discipline, sometimes luck, and sacrifice (sometimes real, but often perceived).

And, if you haven’t noticed, the ones who do stumble upon a windfall personal finance shortcut: lottery winners, mega-contract athletes and artists, etc. – often quickly blow through those funds like they were never there.

There is something to be said for building up the knowledge, discipline, effort, sacrifice, and gratitude that 99%+ of us will need in order to get to the personal finance promise land. And stay there.

No quick shortcuts. But, it’s better that way.