It could rightfully be argued that the single greatest human survival adaptation that we have developed is our ability to plan far into the future. Almost every other form of life on this planet very much lives moment-to-moment or in the very near term (with some notable exceptions – huge shout out to nut-burying rodents).

This species adaptation has paid multi-year, multi-decade, and even multi-generational dividends. It led to the creation of language, to agriculture, livestock farming, home and community building, historical records, education, monetary value, business, banking, medicine, technology, and nearly all of the fruits that we enjoy in our modern day civilization. It led to a health and population boom for the human species, which previously had a numerically-limited, insignificant, disease-ridden, and short-lifespan existence.

And while there can be many downsides to always living too far into the future (or past), it’s an adaptation that I don’t think we would willingly want to give up.

Sadly, when it comes to money, many of us do, whether we realize it or not.

Despite historically high levels of wealth, our personal savings rate has dipped down to and stayed in the 3-10% range for the last 35 years. Meanwhile, we’ve ridden ourselves with historically high levels of home, auto, education, and consumer debt (long-term financial adaptation in reverse, if you will). And median net worth and retirement savings are a pittance of where they need to be in order to be considered viable.

Why is that?

Let’s call it the “Good Times Paradox”.

During good economic times, when we see income gains and low risks, we let our finances slip. We let our guard down. Our spending increases, savings rate declines, and personal debt increases. The Good Times Paradox effectively erases the human adaptation of planning for the future.

I witness this every single day from many of my very intelligent colleagues. We are mostly young, and all in well compensated roles at a company that is performing very well financially. We all earn much more than the median household income. Right now is precisely the time that we should be packing away as many nuts as we possibly can for the future. Yet, very few of my colleagues take full advantage of the company’s generous 50% 401K match. Far fewer save any money outside of their 401K. Close to zero have paid off their mortgage, or saved enough to reach financial independence. And, based on conversations, it seems like very few are even thinking about those things. I find it baffling. Many are relinquishing their greatest human adaptation, to the possible detriment of their future. And they surely are not alone.

I’ve taken a different path. From day one (currently in year 12), I saw my employment situation as something that should never be taken for granted. Instead of boosting spend levels concurrent with income levels, I’ve looked for ways to keep my personal inflation rate as close to zero as possible. As a result, my income has almost tripled, while my spend has not increased any more than the macroeconomic consumer price increases that are out of my control.

It doesn’t keep me awake at night, but I’m always aware that any day, all of this could come to an end. My company’s financial fortunes could come to an end. Another recession and job cuts could hit. Regulation or antitrust threats could emerge. Consumer and industry trends could significantly change. I could burn out and my job performance could change. My boss could change. My bosses boss could downsize the team. My health could change. My family’s health could change. All jobs are temporary. And the data shows that your earning potential flat-lines by your 40’s.

All of these things are almost entirely out of my control. Luck and personal finance go hand-in-hand. In fact, my luck partially ran out earlier this year, with a forced job relocation.

An interesting phenomenon has happened during each of the last 8 U.S. economic recessions, seemingly at the flip of a switch. When job losses occur and incomes decline, our average personal savings rate actually significantly increases! In terms of available resources, the exact opposite should be true, but when confronted with a potential threat, we tend to hunker down and prepare for the future.

What is the solution to overcoming the Good Times Paradox? In short, it’s ignoring that the “good times” are happening at all, and living humbly, no matter what the economic bounty. Here are a few things that can help with that:

1. Understand our natural and adaptive tendencies: it’s important for us to understand that despite our great adaptation of planning for the future, we have a strong tendency to drift back to our current condition. And when it comes to finances, we need to harness the power of long-term planning. Recognizing that is key.

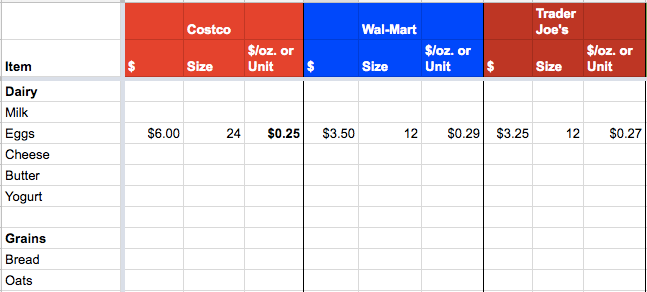

2. Spend time on your finances: according to the U.S. Bureau of Labor Statistics, the average American spends just 1.8 minutes per day (12.6 minutes per week) managing their household finances, on average. A 40-hour workweek is 2,400 minutes. That means that we spend roughly 200X more time earning money than we do managing it. That ratio has to change. 1-2 hours of personal finance time investment per week should be more than enough. Use that time to track spending and to keep your inflation rate in check. It’s hard to be lulled to sleep when you have objective numbers in front of you that you frequently review.

3. Practice gratitude: last year’s iPhone was the best personal device everyone in the history of humankind had ever used when it was released. It’s still damn good this year. And it will still be damn good in a few years. Practice gratitude for what you have and rationally debunk your FOMO with every potential purchase.

The freedom of choice. The freedom of fear. The freedom of time.