I’ve been thinking a lot lately about economic class and the moral and ethical implications that come with it.

Over the years, through a mix of hard work, execution of the financial advice that I’ve share on this site, and a lot of luck, I (and Mrs. 20SF) have been able to build a net worth that we would not have thought possible just a decade ago.

One thing that I’ve noticed, as our wealth has increased, is that it has become quite a bit easier to build even more wealth over time. For example, the income produced by our fairly conservative investments now surpasses our average annual expenses (often referred to as reaching the “crossover point” of financial independence). The impact of this is that – without any additional effort or time worked – we are able to save more of the income we make from our jobs. In fact, we’re now able to save ALL of the income we make from our jobs.

Wealth begets more wealth. But this self-perpetuating wealth cycle doesn’t just come in the form of investment income. It comes in MANY different forms.

For example: wealth and cash flow means that our credit card payments are always on time. And over the years, this has had a number of compounding benefits:

- we both have “excellent” credit scores.

- we pay no interest for use of credit cards.

- we’re approved for any credit card we apply for.

- we’re approved for as many credit cards as we’d like (which is now in the dozens in just the last few years).

- we would pay less for loans (if needed) and other financial products (i.e. insurance) that rely on credit scores to determine rates.

- we get cash back, travel insurance, preferred status, other big perks, and significant rewards for using credit cards. We haven’t paid for a flight or hotel room in years from signup bonuses alone on top airline and hotel rewards credit cards.

Another example: when the term life insurance policy we bought 13 years ago expires in 2 years, we have no need to renew/replace it. If one of us were to pass, the other would be totally fine on their own financially.

Another example: we only have liability insurance on our vehicle, which saves us hundreds per year. If we get in to an accident that results in a total vehicle loss, we could easily turn around the next day and buy a new vehicle. We’re effectively self-insured and have cut out the insurance middleman.

Another: a few years ago, we paid off our mortgage, so we don’t have a mortgage or rent. Instead, we make interest on the added saved funds that used to go to mortgage/rent.

I could go on and on…

Now, I say of this to brag. It took a lot of hard work to get here, but also a lot of luck and privilege. We constantly practice gratitude for the situation we are in.

Sadly, the cycle that perpetuates wealth for those that have it, also works in reverse for those who do not. And this is where this feel good story takes a dark turn. For example:

- Having a poor credit score leads to higher interest rates. This can escalate to absurd interest rate levels, including an APR of 400%+ on payday loans.

- Having a lack of cash flow leads to more borrowing, which leads to higher interest rates and more interest paid.

- A lack of cash reserves increases the need for insurance and more insurance to cover the cost of unexpected expenses (life, auto, home, health, renter’s, etc.).

- Insurers charge more for perceived lower economic status and lower credit scores. One auto insurance analysis found that “the average premium for all drivers with indicators of high socioeconomic status was just over $1,140, while the average quote for the low-economic-status drivers was $1,825.”

- Not being able to afford proper insurance results in large out-of-pocket costs during emergencies and can lead to more borrowing and interest paid.

- A lack of cash flow leads to less saving, which leads to lower or no investment returns.

- A lack of savings leads to the need for paying premiums on leased/rented products and housing.

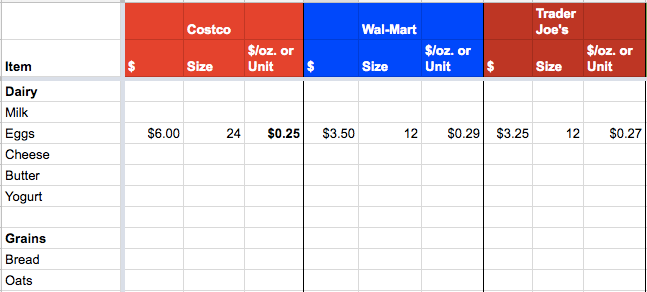

- A lack of cash flow prevents the ability to buy products in bulk for cheaper costs and/or when items are on sale for future use, and lack of space prevents lack of storage of bulk items. For example, a study from the University of Michigan tracked toilet paper purchases of over 100,000 American households for 7 years and found that high income households bought toilet paper on sale 39% of the time, compared to 28% for low income households. They also bought more rolls on average compared to low income households. Overall, the study found that low income households pay about 6% extra per sheet.

- A lack of cash flow prevents the purchase of items that can improve health and prevent health problems (i.e. exercise, healthy foods, medicine, health care) – which can result in its own cycle of increased costs through more expensive and sometimes reactive health costs.

- A lack of cash flow can result in the need to take out more student loans, and pay more interest on those loans for a longer period of time.

- Inability to afford an education results in significantly decreased lifetime earnings versus each subsequent level of education.

And these are just a few. There is no better way to describe this collective disadvantageous financial ball-and-chain than a “poor tax”. Whether self-induced or not, being poor can result in a continuous destructive cycle of poverty. And breaking that cycle is incredibly difficult.

In fact, there are entire industries that recognize these inequities and create products to prey on those who suffer from them.

What are the lessons in all of this? I think there are a few that we should all take to heart to address this: