(Picture: The Star)

(Picture: The Star)

UOB Financial institution has launched a brand new service dubbed UOB Infinity for its company purchasers, enabling them to now handle their banking wants in a less complicated and personalised method. It comes with a number of options, together with having a customisable on-line dashboard in addition to the flexibility to trace cross-border funds in actual time.

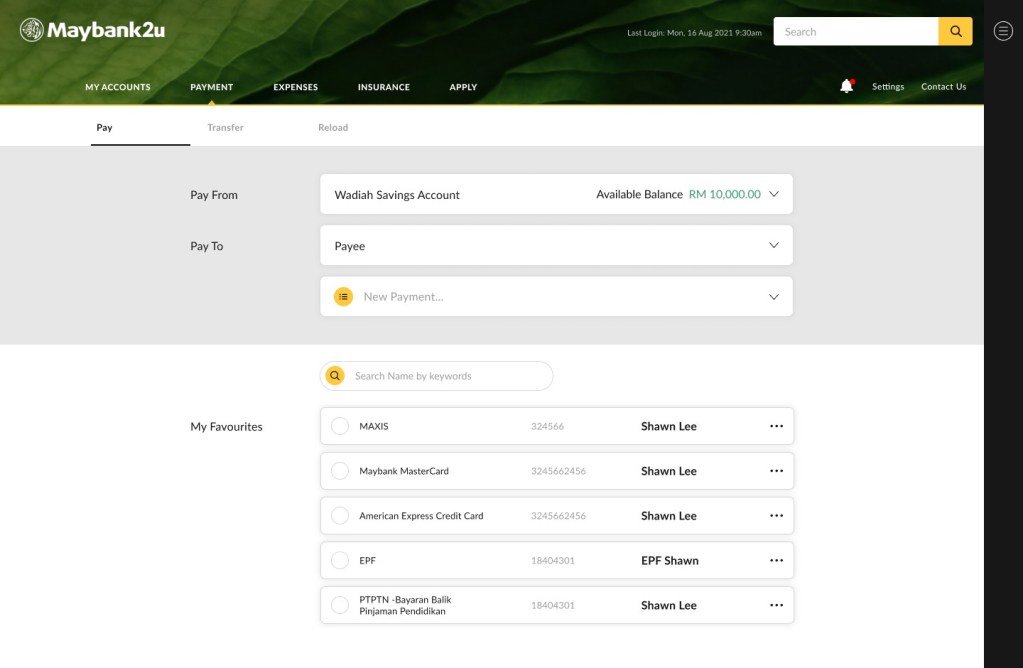

In a press release, UOB highlighted that UOB Infinity’s customisable on-line dashboard will enable purchasers to prioritise and visually show data which might be most related to them, thereby providing supply a consolidated view of your organization’s funds at one look (together with abroad market). Moreover, it features as a kind of one-stop centre; purchasers can handle a spread of home and cross-border banking actions – from checking their accounts throughout numerous markets to creating native and worldwide funds – with out having to log into a number of platforms.

Other than that, UOB Infinity additionally enables you to to trace cross-border funds in actual time – one thing that’s typically uncared for for the company shopper phase. With this service, company purchasers will be capable to obtain real-time notification of their funds by way of SMS or e mail, which suggests they won’t must manually examine on the standing of their transactions.

UOB Infinity may also clearly show all its charges and expenses for cross-border transactions, together with these from the middleman banks. This supplies better transparency on the prices incurred, which might be helpful within the occasion of any disputes. Safety-wise, all transactions are authenticated with digital tender tokens and multi-factor authentication.

When it comes to cost choices, UOB Infinity can also be geared up with a complete vary of cost functionalities. Purchasers could make a variety of funds from the service itself – resembling native invoice funds to home and cross-border fund transfers – by way of numerous cost providers, together with Interbank GIRO (IBG), JomPAY, Actual-Time Digital Switch of Funds and Securities System (RENTAS), and telegraphic transfers. Not solely that, purchasers may generate QR codes by UOB Infinity to request for DuitNow funds from their very own clients.

Whereas clients can entry UOB Infinity by way of its devoted web site, it’s also out there as an app for many who are at all times on the go (downloadable from Google Play and the App Retailer). As soon as downloaded, purchasers may have the choice to arrange their biometrics on the app for higher safety and comfort. In the meantime, purchasers utilizing UOB’s present enterprise web banking platform, UOB BIBPlus, can go forward and log in to UOB Infinity utilizing the identical credentials.

“At this time’s launch of UOB Infinity is yet one more proof level of UOB Malaysia’s dedication to assist corporates adapt to the brand new realities of the digital economic system. By leveraging insights from our purchasers, we have now developed UOB Infinity to handle the various wants of corporates, together with their commerce necessities and the flexibility to maintain monitor of their firm in real-time throughout the markets the place they function,” stated the chief government officer of UOB Malaysia, Ng Wei Wei.

Ng additionally emphasised that UOB’s objective is to assist its shopper enhance their operational effectivity and make higher enterprise choices by digitalisation. That is on high of providing help in order that they’ll seize alternatives regionally by the financial institution’s connectivity.