(Image: The Star/Muhamad Shahril Rosli)

(Image: The Star/Muhamad Shahril Rosli)

The Association of Banks in Malaysia (ABM) and the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) have reassured Malaysian cardholders that their data security continues to be of utmost importance to banks. This came following a recent notice from iPay88, which reported a cybersecurity incident that may have potentially compromised customers’ card data.

In a joint statement, both associations said that banks have implemented several extra countermeasures to mitigate the potential risks that may arise from the incident. These include real-time fraud monitoring to identify fraudulent and abnormal card usage behaviour, among other approaches.

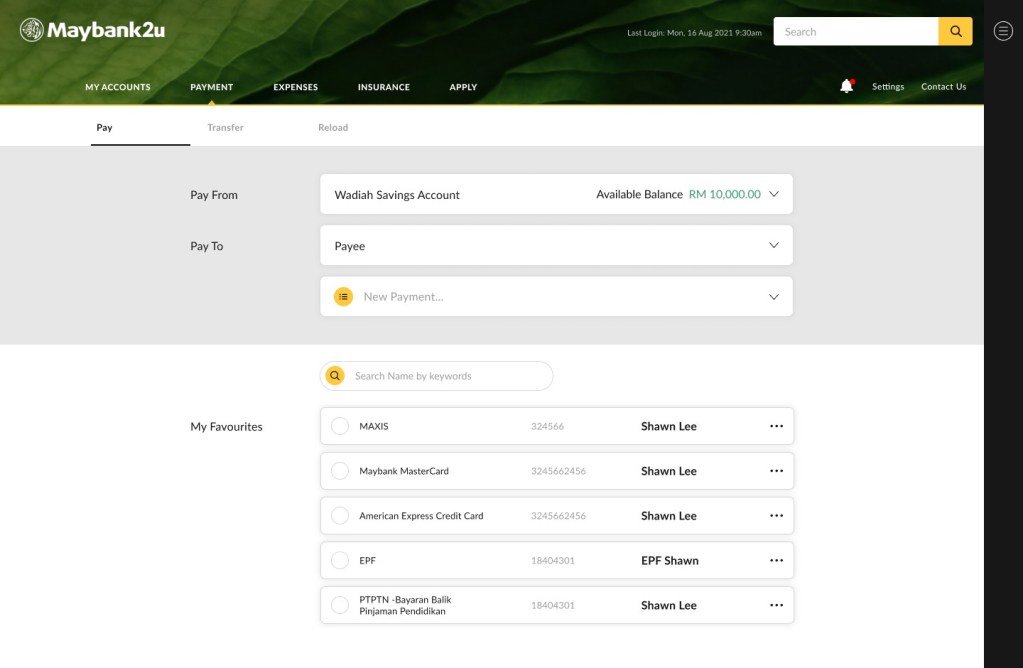

Aside from that, banks have also put in place multi-layer security measures such as dual-factor authentication to prevent unauthorised credit card and debit card transactions. If unusual transactions that may require added verification are detected, they will reach out to their cardholders directly through official channels to clarify matters.

As such, ABM and AIBIM said that cardholders can continue to use their bank cards as per normal. They are reminded, however, to closely monitor their bank statements and any transaction alerts received.

“In the event cardholders detect any unauthorised transactions, they should immediately contact their bank at the number printed on the back of the bank card for assistance. Cardholders are reminded that in light of more sophisticated cyber security threats, it is important to be vigilant at all times,” both associations said. Alternatively, bank customers can obtain the contact details for all ABM and AIBIM bank members from the associations’ respective websites.

For context, online payment gateway iPay88 had recently revealed that it experienced a cybersecurity breach in May 2022. An investigation was immediately carried out on 31 May after discovering the breach, and the containment process was successfully completed with no further suspicious activity having been detected since 20 July. It has since alerted its financial institution partners and are working with the relevant authorities on the matter, and will also share detailed findings in due course.