Try not to freak out too much, but you should be aware that there are a number of troubling economic indicators that are flashing bright red right now that point to increased odds of an oncoming recession:

- Business investment fell in the most recent quarter and manufacturing has been declining since the beginning of 2019. These were supposed to be the big winners of the 2017 Trump/Republican tax plan. But instead of investing in business and wages, companies have mostly used the tax break to buy back shares at a record high pace, enriching their shareholders (including themselves), not employees. And the tax plan added $1.9 trillion in red ink to the country’s balance sheet, after accounting for growth.

- The ongoing trade war has been ratcheted up and will result in further price increases for consumers. J.P. Morgan estimates that the trade war will cost households an average of $1,000 – $1,500 per year. That’s a huge tax increase that could impact the economy in a very negative way. For comparison’s sake, the tax plan has been estimated to save households an average of $1,300, but the largest share of that went to the highest income households. Many households actually saw a tax increase.

- The Federal Reserve recently issued its first interest rate cut since the Great Recession. The Fed, who spends all of its time pouring over economic data, cuts rates when it sees troubling economic signs and wants to stimulate the economy.

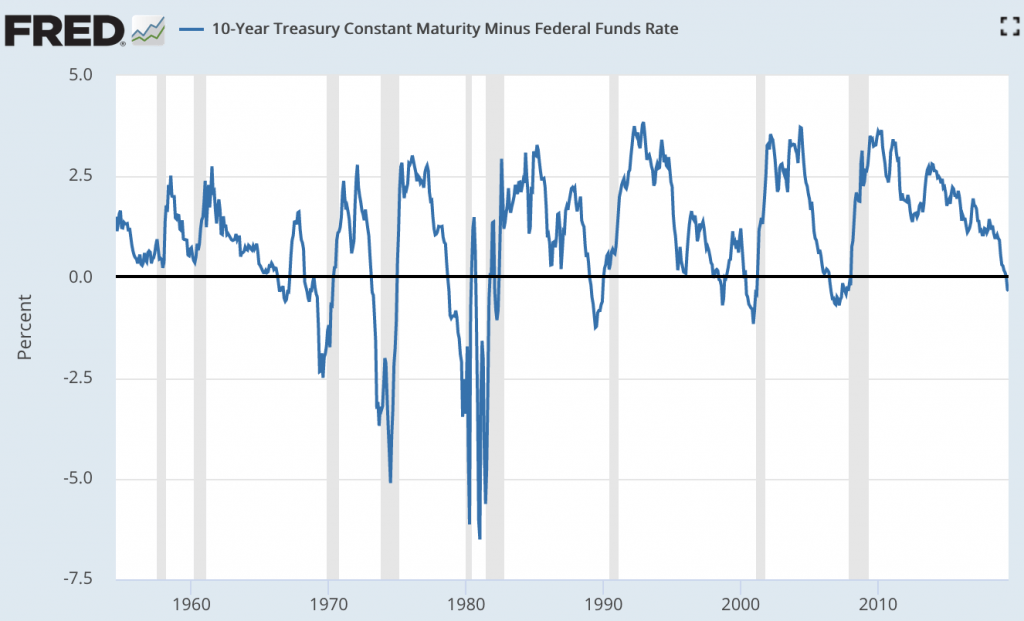

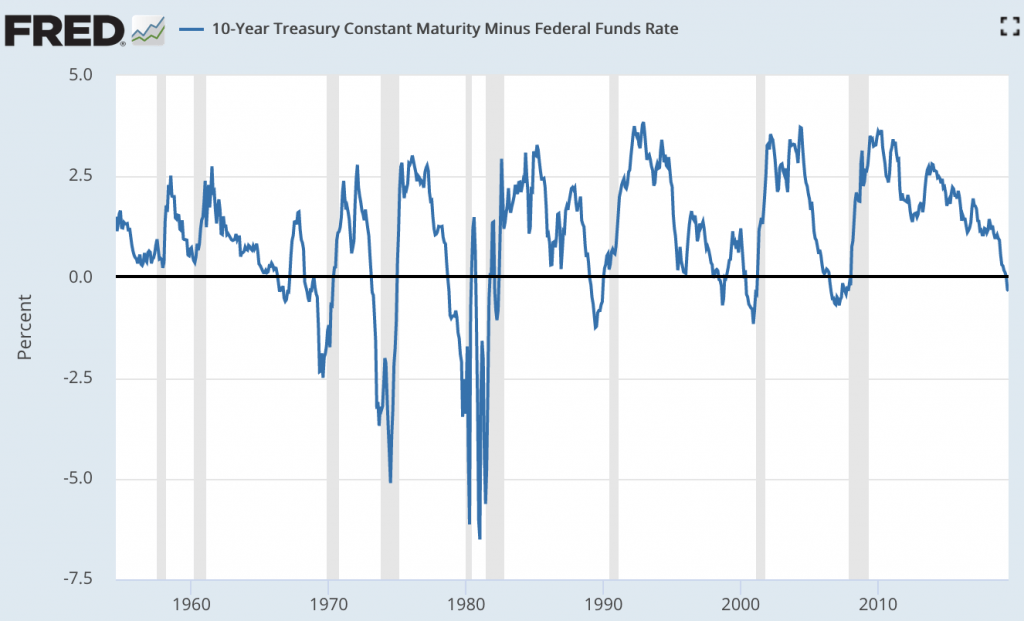

- We now have an inverted yield curve, which means that interest rates on short-term bonds are now higher than on long-term bonds. An inverted yield curve closely preceded 6 out of the last 6 recessions (grey in the chart below), going all the way back to 1975. So it’s no small thing. And we’re now in similar territory on the spread on short versus long term yields to where we were just before the Great Recession.

Graph: Inverted Yield Curve (below 0%) & Recessions (Grey)

To be clear, I’m not in the recession prediction business. I don’t know when the next recession will hit. But I do know that another recession will eventually hit at some point. And these signs are indicators that it could happen sooner than later. It is in your best interests to prepare for the next recession, whenever that may come.

Back in 2008, at the onset of the Great Recession, Mrs. 20SF’s job was a casualty. She was just over a year into her job (which was seemingly going well) when she received the life-altering news. Not only were we not prepared for that moment and were left in total shock. At my employer, a number of colleagues lost their jobs as well right around the same time. Thankfully, I managed to avoid the cut. The circumstances forced us to look at everything through a new lens – and Mrs. 20SF entirely changed careers, in part, to avoid the constant threat of a repeat experience.

In total, 8.8 million Americans lost their jobs during the Great Recession. The next recession will see job cuts. It will see wage stagnation or even declines again. It will see an increase in foreclosures, bankruptcies, high-interest debt, and financial pain.

How can you prepare for the next recession in order to limit your risk of exposure to all of the downsides, starting right now? Here is what I’d recommend.

1. Fortify your Emergency Fund Beyond Recommended Levels

This year, the average duration of unemployment has ranged between 18.7 to 24.8 weeks (or, approximately 6 months on the high end). The typical personal finance advice is to have an emergency savings fund of 6 months of living expenses, which would cover that average (just barely).

However, during the Great Recession, the average duration of unemployment peaked at over 40 weeks (~10 months). At the time, I wrote that a 1-year emergency fund was much more legitimate, given the circumstances. Readers would be wise to make a minimum of 1-year in emergency savings their new normal, in perpetuity.

2. Build your “Social Capital”

Imagine that a recession has begun and the “higher ups” are gathered in a room, earnestly debating which 25-50% of the workforce they are going to lay off. How those people remember you and how warmly they feel about you could seal your employment fate. Often times, in the workplace, likeability carries far more weight than job performance (though boosting your job performance at the same time wouldn’t hurt either).

This same principle not only impacts those you work with, but the people you interact with in your neighborhood, in your social circle, in volunteer roles, and elsewhere. If you have lost your job, none of those people care particularly much about bullet points on your resume. If they like you, if you’ve helped them in the past, and/or if you’re genuinely a good person – they are going to go to bat for you. We’re social beings. We judge. We form opinions. And we help the people we like.

No need to be calculating here, just focus more on helping others and being likeable, without keeping score. It will enrich the lives of others and yourself, and make the world a slightly better place. Recession or not, it will pay dividends.

3. Pay Down High-Interest Debt

There’s never really a bad time to pay down high-interest debt. But in advance of a recession is a particularly good time to do so.

The Great Recession saw a massive foreclosure crisis. A large part of that was people taking on too much debt. But the untold story was all of the additional high interest debts on top of mortgage obligations that made keeping up with those payments impossible.

The greatest positive force in personal finance is the power of compound investment returns. There is an opposite and equally as powerful of a force on the negative side: high-interest debt. High interest debt is the equivalent of compound interest working against you. And once it snowballs, it’s nearly impossible to reverse course.

Here are some debt payoff strategies to consider. In general, I would recommend paying off the highest interest debt first and working your way down from there. Anything over 5% APR these days, should be considered high interest.

4. Review and Trim the Fat in your Expenses

There’s really no bad time to trim back the fat in your expenses, but we have the tendency to not prioritize this, or get complacent in prioritizing this. Everyone, myself included, needs periodical expense check-ups.

Start by documenting all of your expenses (here’s a free budget spreadsheet to help with that). Once documented, you could start by focusing on the following:

- Get comparison quotes for auto, home, life, health, & other insurance to make sure you’re still getting the best rates

- Closely scrutinize all recurring expenses to determine if they are still worth it or if better/cheaper alternatives exist. This may include monthly app, cable TV, video/music streaming, phone plans, etc.

- Review your electricity, water, and other utility use for waste.

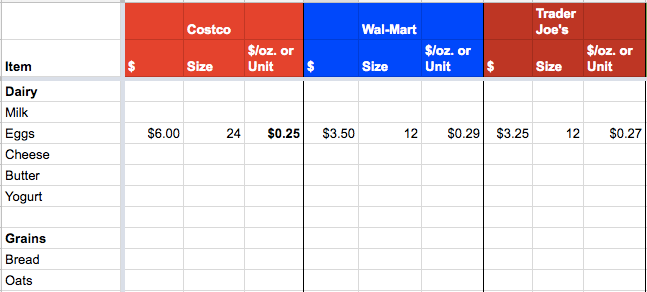

- Buy food in bulk and cook more at home to reduce food consumption costs. Shift more meals to vegetarian. Once you’ve done that, use a grocery price list spreadsheet to compare and reduce your grocery costs.

- Look for ways to drive down your transportation costs (i.e. cutting lease, buying used, shifting to bike/carpool/mass transit).

- Housing costs are the highest expense category for Americans. Are there ways for you to cut back? Do you need as much space as you are paying for? Do you need the location you are paying for?

- Truly examine the wants vs. needs in your spending.

Cutting expenses allows you to boost your personal savings rate. If you’re able to boost your personal savings rate to 50%, you’ll be saving up an emergency savings fund equivalent to 1 year for each year you work. At 75%, you’ve saved up 3 years.

Final Thoughts on How to Prepare for a Recession:

If you sensed a theme here, it’s that ALL of these suggestions, while particularly helpful to focus on in advance of a recession, are all around best practices for anyone and everyone looking to live a better life. At any time. And with no downsides. So why not get started now?

I’m eager to throw this one out to the readers: