Buried deep (on page 35) in a previous Berkshire Hathaway shareholder letter was a Warren Buffett gem,

“It is madness to risk losing what you need in pursuing what you simply desire.”

The context around this nugget of wisdom referred to not taking greedy risks for short-term profits with Berkshire Hathaway investments and business offerings. However, this piece of advice applies exceptionally well to personal investments and more broadly to many different areas of life. Lets look at a few.

Personal Investments

Buffett has given great advice on where amateur investors should invest,

“In the 20th century, the Dow Jones industrial index advanced from 66 to 11,497, paying a rising stream of dividends to boot. The 21st century will witness further gains, almost certain to be substantial. The goal of the nonprofessional should not be to pick winners — neither he nor his “helpers” can do that — but should rather be to own a cross section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.”

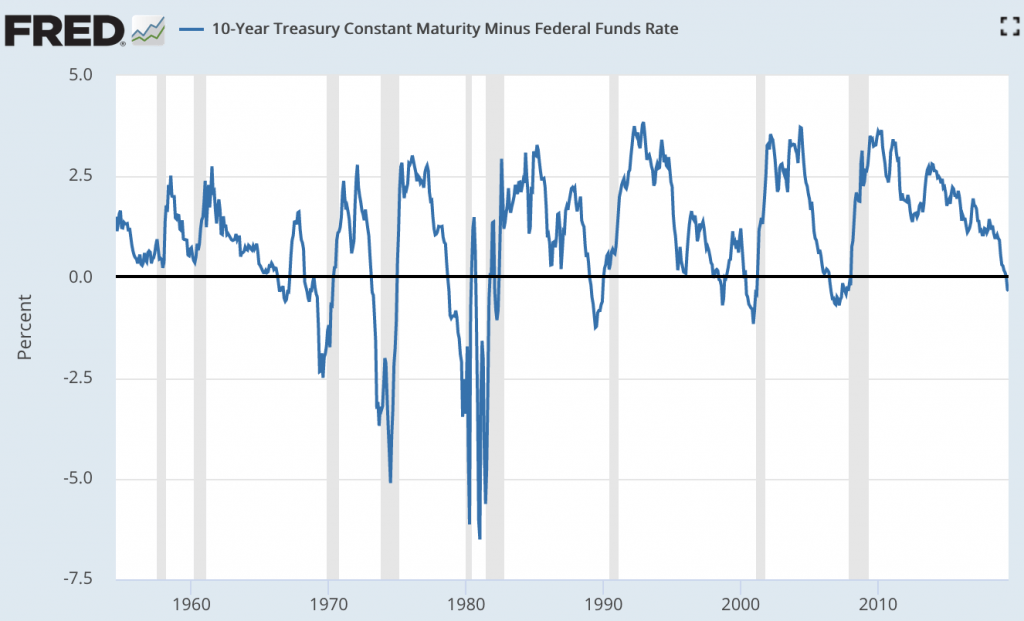

In fact, passively investing with low-cost index funds has proven to be a more successful strategy than entrusting your funds to professional stock pickers (who have significantly higher management fees). Yet many of us don’t want to settle for “average” market returns “because it’s boring“, even if those returns are more than adequate in fueling net worth growth and retirement. We want to go further and see immediate short-term growth explosions. So we give our money to professionals or even try our own hand at stock picking. And when we do, we rarely go with rock solid companies, we instead go for the volatile ones that have a 10X upside if XYZ miracle occurs.

In investing, when greed wins, we lose.

Career & Wealth

Oh, the allure of a high profile career and wealth…

How many have sacrificed their precious time on this planet with family and loved ones in pursuit of more money, prestige, and power in their careers?

I picked on Google CFO Patrick Pichette’s retirement announcement a while back because I didn’t think retiring on $200 million+ in the bank was an applaud-worthy event. However, in his early 50’s, Pichette now has an opportunity to have a much more balanced life than he did when his hedonic pursuit of more led to him admittedly neglecting his wife and children. Will he? I would not bet on it. Most who reach that level of career pinnacle never go back to a balanced life – the greed for more money and superficial ego-boosts becomes all-consuming. Even if they try to leave, they quickly get sucked back in. To what end?

I picked on Google CFO Patrick Pichette’s retirement announcement a while back because I didn’t think retiring on $200 million+ in the bank was an applaud-worthy event. However, in his early 50’s, Pichette now has an opportunity to have a much more balanced life than he did when his hedonic pursuit of more led to him admittedly neglecting his wife and children. Will he? I would not bet on it. Most who reach that level of career pinnacle never go back to a balanced life – the greed for more money and superficial ego-boosts becomes all-consuming. Even if they try to leave, they quickly get sucked back in. To what end?

There may be a few cases where extreme random luck has resulted in the ability to “have it all” in career and life at home, but for most of us, the two are inversely correlated. As time devoted to one goes up, time devoted to the other goes down. We need our families. We may think we want career prestige and gluttonous wealth, but we certainly don’t need it.

Homes, Autos, & Other “Stuff”

The pursuit of stuff has left us as a nation of debtors – at risk of losing it all.

Let’s start with homes. The median new home size in the U.S. recently hit 2,306 square feet – the highest ever. In fact, it’s gone up just about every year since the mid 1980’s. This, with the average American household containing a record low 2.55 people (904 sq. ft. per occupant). Compare that to 40 years ago, when the average household size was 3.01 people and the median new home size was 1,550 sq. ft. (514 sq. ft. per occupant).

Of course, home prices coincide with home sizes. The bigger the home, the bigger the cost. When you take out massive debts to finance more home than needed, you put ourselves at great risk. Should you face a career or other financial setback, you risk foreclosing on and losing the home altogether. How much home do you really “need”?

Transportation costs in the United States have hit a mean of $9,211 per year per per 2-person household. That makes transportation the second highest expense category for Americans – 39% more than the food we eat to keep us alive!

Then there’s all the stuff and toys that even the wealthiest of royalty over the centuries could never have dreamed of possessing – yet somehow, it’s all become a false necessity for us.

… I won’t go in to food, entertainment, alcohol/drugs, relationships, sex and all that other stuff, but the same principle applies. I think you get the idea. Moderation, humility, restraint, and “good enough” win the day.